Institution of Health & Beauty Canadian College

- We believe everyone should have the opportunity to learn through our program in Medical Aesthetics, Permanent makeup, Skin Care Nail and more.

Institution of Health & Beauty Canadian College

- We believe everyone should have the opportunity to learn through our program in Medical Aesthetics, Permanent makeup, Skin Care Nail and more.

Welcome to the Health & Beauty Canadian College

We provide more detailed information on full time and part time Diploma and Certificate program and also tuition payment plans can be negotiated, for those who want to enter into the aesthetics world and industry Professionals who will flourish in the rapidly changing salon and spa market.

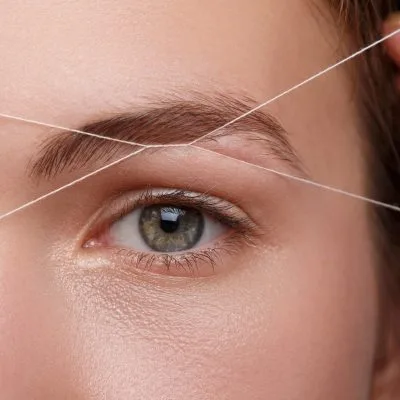

Through our program in Medical Aesthetics, Permanent makeup, Skin care, Nail and more. The Health and Beauty Canadian College offers top-level Cosmetology and Aesthetics ourses, full menu of beauty in the salon and spa services.

Fully Canadian Certified

Our skincare services focus on refreshing and rejuvenating your skin with the latest and greatest techniques available.

Our Featured Courses

Health & Beauty Canadian College

CPR & First Aid Course

A CPR and First Aid Course offered in Health and Beauty Canadian College equips students with critical emergency response skills, focusing on cardiopulmonary resuscitation (CPR) and basic first aid practices. This training is beneficial for students pursuing careers in healthcare, early childhood education, or community service roles.

Course Outline and Components:

Introduction to CPR and Emergency Response

Overview of emergency situations and the importance of early intervention.

Key responsibilities of a first responder, including safety assessments.

CPR for All Ages

Hands-on practice with CPR techniques for adults, children, and infants.

How to recognize cardiac arrest and unresponsive individuals.

Safe and effective use of an Automated External Defibrillator (AED).

Basic First Aid Techniques

Wound care basics, including control of bleeding, burn treatment, and bandaging.

Management of fractures, sprains, and other musculoskeletal injuries.

Recognizing and assisting in choking, allergic reactions, and seizure cases.

Handling Life-Threatening Medical Emergencies

Techniques to handle heart attacks, strokes, respiratory distress, and shock.

Monitoring and supporting vital signs until professional help arrives.

Infant and Child-Specific Techniques

Tailored CPR and first aid techniques for infants and young children.

Addressing common pediatric emergencies like fevers, falls, and poisoning.

Legal and Ethical Considerations

Overview of Good Samaritan laws, consent requirements, and the legal implications of administering first aid.

Documentation practices and maintaining confidentiality in emergency care situations.

Course Logistics:

Duration: Typically a one- or two-day intensive course, with approximately 6-8 hours of instruction and practice.

Certification: Upon successful completion, students receive CPR and First Aid certification, in compliance with recognized health organizations.

Benefits for Students:

This course provides students with the confidence to manage medical emergencies safely, enhancing both personal and professional skill sets. It’s an essential qualification for fields requiring hands-on care and safety responsibilities.

Our Instagram Feed

What our Customers Say.

Great Teacher

I must say that I have no doubt that I went to one of the best beauty academy there is. I feel like when I graduated I was ready to work and build up a clientele right away. After working in a salon for less than three years I was ready to go on my own. Ten years later being a single mother of two teenage girls I am able to work three and a half days a week and be my own boss. I own my home and I am able to travel at least four times a year… I could not accomplish all of that without getting the best education at the one and only Health & beauty Canadian collage! Thank you Ms. Azadeh and all the wonderful teachers.

Dianne Ameter

Student

Excellent Teaching

I can't thank Ms. Azadeh, and the amazing staff of teachers that mentored and guided me to the successful career I have today. I started off working for commission, built up my clientele and for the last 8 years have been on my own renting a booth. I have found great success with all the education and motivation instilled in me from day one of class at Cameo. I am able to make my own hours and spend time with my two children and even decided to work part time at my father’s assisted living home doing the little old ladies hair…(thank GOODNESS I can do a rollerset…they DO come in handy). Thank you Ms. Azadeh!!!

Ruby Sprout

Student

Easy Teaching Methods

I must say that I have no doubt that I went to one of the best beauty academy there is. I feel like when I graduated I was ready to work and build up a clientele right away. After working in a salon for less than three years I was ready to go on my own. Ten years later being a single mother of two teenage girls I am able to work three and a half days a week and be my own boss. I own my home and I am able to travel at least four times a year… I could not accomplish all of that without getting the best education at the one and only Health & beauty Canadian collage! Thank you Ms. Azadeh and all the wonderful teachers.